When you buy something through one of the links on our site, we may earn an affiliate commission.

Investing in rental properties can be a fantastic way to build wealth, generate passive income, and secure your financial future. But if you’re a first-time investor, the process can seem overwhelming. This step-by-step guide will walk you through everything you need to know to get started with buying your first rental property—from financing and choosing the right location to tenant screening and management.

Step 1: Define Your Investment Goals

There are several rental property investment strategies to consider, each with its own set of advantages and challenges:

Fix-and-Flip: While not a traditional rental strategy, fix-and-flip involves purchasing a property, renovating it, and selling it for a profit. This strategy requires a significant upfront investment and a good understanding of the local real estate market. It also involves more risk as sometimes it’s difficult to estimate the renovation costs upfront as problem can be discovered during the renovation process.

Short-Term Rentals: Short-term rentals, such as vacation homes or Airbnb properties, can generate higher rental income but require more active management. This is a good strategy for properties in high-demand tourist areas.

Long-Term Rentals: This strategy involves renting out the property to tenants on a long-term basis (typically one year or more). Long-term rentals provide a steady stream of income and are generally less management-intensive than short-term rentals. For someone purchasing their first rental property, this would be the easiest investment strategy to start with.

Set Financial Goals

Your financial goals will influence the type of property you buy, the location, and your overall investment strategy. Consider the following questions:

- How much rental income do you want to generate?

- What is your target return on investment (ROI)?

- Are you looking for cash flow, appreciation, or both?

- How long do you plan to hold the property?

Having clear financial goals will help you stay focused and make decisions that align with your investment objectives.

Step 2: Determine Your Budget

Before diving into the world of rental property investment, it’s crucial to assess your financial readiness. This involves evaluating your current financial situation, understanding the costs associated with buying and maintaining a rental property, and determining whether you’re in a position to take on this investment.

Evaluate Your Credit Score

Your credit score plays a significant role in securing a mortgage with favorable terms. Lenders use your credit score to assess your creditworthiness and determine the interest rate on your loan.

To qualify for a conventional loan on a rental property, you’ll typically need a credit score of at least 680-700, though a score of 740 or higher will secure the best interest rates and loan terms. A higher credit score not only improves your chances of approval but also leads to lower interest rates, reducing your monthly mortgage payment and overall loan cost.

Borrowers with lower scores may still qualify but will likely face higher rates, stricter lending criteria, and larger down payment requirements—often 25% or more instead of the typical 20%. Additionally, lenders may require more cash reserves for those with lower credit scores.

Since investment properties are riskier for lenders, maintaining a strong credit profile is crucial to securing favorable financing terms and maximizing cash flow on your rental investment. To improve your credit score, pay down existing debt, make timely payments, and avoid opening new credit accounts before applying for a mortgage.

Calculate Your Debt-to-Income Ratio (DTI)

Lenders also consider your debt-to-income ratio (DTI) when evaluating your mortgage application. Your DTI is the percentage of your monthly income that goes toward paying debts, including your mortgage, credit card payments, student loans, and other obligations.

A lower DTI indicates that you have more disposable income to cover your mortgage payments, making you a less risky borrower. Most lenders prefer a DTI of 36% or lower, though some may accept higher ratios depending on other factors.

Save for a Down Payment

While the down payment requirement for a primary residence is typically around 3-20%, rental properties usually require a larger down payment. Most lenders require a down payment of 20-25% for investment properties. Saving for a substantial down payment not only reduces your loan amount but also improves your chances of securing a mortgage.

Build an Emergency Fund

Owning a rental property comes with unexpected expenses, such as repairs, vacancies, and property management fees. It’s essential to have an emergency fund to cover these costs without jeopardizing your financial stability. Aim to save at least three to six months’ worth of expenses in an emergency fund.

Step 3: Research the Market

Once you’ve assessed your financial readiness and defined your investment goals, it’s time to research the market. Understanding the local real estate market is crucial to making a smart investment.

Choose the Right Location

Location is one of the most important factors in real estate investment. A property in a desirable location is more likely to attract tenants and appreciate in value over time. Consider the following factors when choosing a location:

- Job Market: Areas with strong job growth tend to attract more renters.

- Population Growth – More people moving in means higher rental demand.

- Schools: Properties located near good schools are often in high demand, especially among families.

- Amenities: Proximity to shopping centers, restaurants, parks, and public transportation can make a property more attractive to tenants.

- Crime Rates: Low crime rates are a key consideration for renters and can impact the property’s long-term value.

- Landlord-Friendly Laws – Some states favor landlords over tenants in legal matters.

Analyze Market Trends

Understanding market trends can help you identify opportunities and make informed decisions. Look at factors such as:

- Rental Demand: Is there a high demand for rental properties in the area? A low vacancy rate indicates strong rental demand.

- Rental Rates: What are the average rental rates in the area? Compare rental rates to property prices to estimate potential cash flow.

- Property Values: Are property values in the area appreciating or depreciating? Investing in an area with appreciating property values can lead to long-term gains.

Pro Tip: Use online tools like Rentometer, Zillow, and Mashvisor to analyze rental demand and pricing.

Step 4: Find the Right Property

Once you’ve identified a good market, start looking for properties that fit your investment strategy.

Where to Search

- MLS Listings – Work with a real estate agent.

- Foreclosures & Auctions – Potential for deals, but more risk.

- Off-Market Deals – Network with wholesalers or property managers.

- Online Platforms – Zillow, Redfin, Facebook Marketplace, and Craigslist.

Property Features to Look For

- Low maintenance requirements (avoid fixer-uppers unless experienced).

- Positive cash flow potential.

- Good layout and livable condition.

- Strong rental demand in the area.

Work with a Real Estate Agent

A knowledgeable real estate agent can be an invaluable resource when buying your first rental property. An agent with experience in investment properties can help you identify potential properties, negotiate deals, and navigate the buying process. Look for an agent who specializes in the local market and has a track record of working with investors.

Step 5: Run the Numbers

Once you’ve identified a potential property, it’s time to conduct a thorough analysis to determine whether it’s a good investment. This involves evaluating the property’s financial performance, condition, and potential for appreciation.

Calculate the Cash Flow

Cash flow is the amount of money you have left after deducting all expenses from your rental income. Positive cash flow means the property is generating more income than it costs to operate, while negative cash flow means you’re losing money.

To calculate cash flow, consider the following expenses:

- Mortgage Payment: Include principal, interest, property taxes, and insurance (PITI).

- Property Management Fees: If you plan to hire a property manager, factor in their fees (typically 8-12% of rental income).

- Maintenance and Repairs: Set aside a budget for ongoing maintenance and unexpected repairs.

- Vacancy Rate: Account for potential vacancies by estimating the percentage of time the property may be unoccupied.

- Utilities and Other Expenses: Include costs such as water, sewer, garbage, and landscaping.

Estimate the Return on Investment (ROI)

ROI is a key metric for evaluating the profitability of a rental property. It measures the return you can expect to earn on your investment relative to the property’s cost. To calculate ROI, divide the annual net income (rental income minus expenses) by the total investment (down payment, closing costs, and any renovation expenses).

A higher ROI indicates a more profitable investment. However, it’s important to consider other factors, such as property appreciation and tax benefits, when evaluating ROI.

Calculate the Cap Rate

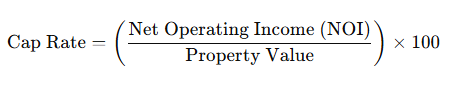

The Capitalization Rate (Cap Rate) is a key metric used in real estate investing to measure the potential return on an investment property. It is calculated using the following formula:

Where:

- Net Operating Income (NOI) = Total Rental Income – Operating Expenses (excluding mortgage payments)

- Property Value = The market value or purchase price of the property

Example Calculation:

- NOI = $24,000 per year (after deducting expenses)

- Property Value = $300,000

Cap Rate=($24,000/$300,000)×100=8%

Why Calculate the Cap Rate?

Real estate investors calculate cap rates because it helps them assess the profitability, risk, and potential return of a rental property.

Quick Property Comparison – Cap rate allows investors to compare different properties regardless of financing. Since it excludes mortgage payments, it provides a pure measure of a property’s earning potential.

Risk Assessment – A higher cap rate (e.g., 8-12%) may indicate a higher return but often comes with higher risk (such as vacancies or market volatility). A lower cap rate (e.g., 3-6%) suggests lower risk but may offer slower returns.

Evaluating Market Conditions – Cap rates vary by location and property type. For example, properties in prime locations (major cities) typically have lower cap rates due to stability, while properties in emerging markets may have higher cap rates.

Estimating Property Value – If you know a property’s NOI and typical cap rates in the area, you can estimate its market value using the formula: NOI / Cap Rate = Property Value.

Determining Investment Strategy – Investors looking for long-term appreciation might accept a lower cap rate, while those prioritizing cash flow often seek higher cap rates.

Step 6: Secure Financing

Once you’ve found a property that meets your investment criteria, the next step is to secure financing. While cash purchases are an option, most investors rely on mortgages to finance their rental properties.

Choose the Right Mortgage

There are several types of mortgages available for rental properties, each with its own terms and requirements:

- Conventional Loans: These loans are not backed by the government and typically require a higher down payment (20-25%) and a good credit score.

- FHA Loans: While FHA loans are designed for primary residences, some investors use them for House Hacking, where they purchase multi-unit properties (up to four units) by living in one unit and renting out the others with just 3.5% down.

- Portfolio Loans: These loans are offered by local banks or credit unions and are not sold to secondary markets. They may have more flexible terms but often come with higher interest rates.

- Hard Money Loans – For quick flips or short-term holds. This is not recommended for first time investors.

- Private Lending – Borrow from investors or family members.

- HELOCs (Home Equity Line of Credit) – Use existing home equity to fund the down payment.

Get Pre-Approved

Getting pre-approved for a mortgage can give you a competitive edge in a competitive market. Pre-approval involves submitting a mortgage application and providing documentation, such as proof of income, assets, and credit history. Once pre-approved, you’ll receive a letter stating the loan amount you qualify for, which can help you make stronger offers on properties.

Compare Lenders

You may want to shop around and compare offers from multiple lenders to find the best terms and interest rates. Consider factors such as the loan term, interest rate, closing costs, and any prepayment penalties. Working with a mortgage broker can also help you find the best loan options for your needs.

Step 7: Make an Offer & Close the Deal

After securing financing, the final step is to close the deal. This involves completing the necessary paperwork, transferring ownership, and officially becoming the property owner.

Review the Purchase & Sales Agreement

The Purchase & Sales Agreement outlines the terms and conditions of the sale, including the purchase price, closing date, and any contingencies. Review the agreement carefully and consult with a real estate attorney if needed to ensure you understand all the terms.

Conduct a Property Inspection

Before finalizing the purchase, it’s essential to conduct a thorough property inspection. A professional inspector can identify any potential issues, such as structural problems, plumbing or electrical issues, and the condition of the roof and HVAC system. Addressing these issues before buying the property can save you from costly repairs down the road.

Conduct a Final Walkthrough

Before closing, conduct a final walkthrough of the property to ensure it’s in the agreed-upon condition. Check for any issues that may have arisen since the inspection and confirm that any agreed-upon repairs have been completed.

Close the Loan

At the closing, you’ll sign the final loan documents and pay any remaining closing costs. These costs may include loan origination fees, title insurance, appraisal fees, and property taxes. Once the paperwork is complete, the property will be officially transferred to your name.

Step 8: Prepare the Property for Rent

Congratulations! You’re now the owner of a rental property. However, the work doesn’t end at closing. Effective property management is key to maximizing your investment’s potential. Before listing, get the property rent-ready.

- Make minor repairs (paint, flooring, appliances, deep clean).

- Install smart locks and security features.

- Take professional photos for listings.

- Set the right rent price based on market rates.

- Create a strong lease agreement.

Step 9: Find & Screen Tenants

Finding reliable tenants is crucial to maintaining a steady rental income and ensuring the long-term success of your investment property. The right tenants will pay rent on time, take care of the property, and follow the lease terms, reducing the risk of costly repairs or legal disputes. To attract quality renters, advertise your property effectively through online listings, social media, and local classifieds. High-quality photos and detailed descriptions can make your listing stand out, drawing interest from responsible applicants.

To avoid nightmare tenants, it’s essential to thoroughly screen all applicants. A solid screening process helps identify red flags before they become major issues, saving you time, money, and stress. By carefully reviewing each potential tenant’s background, you can significantly reduce the risk of late payments, property damage, or eviction.

Tenant Screening Checklist

- Credit Score – A score of 650 or higher is generally a good indicator of financial responsibility.

- Income Verification – Tenants should earn at least three times the monthly rent to ensure they can comfortably afford payments.

- Rental History – Contact previous landlords to confirm on-time payments and responsible behavior.

- Criminal Background Check – This helps identify any past offenses that might pose a risk to your property or other tenants.

- Eviction History – A history of past evictions is a major red flag and could indicate financial instability or lease violations.

By following a comprehensive tenant screening process, landlords can protect their investments and create a positive rental experience for both themselves and their tenants. Taking the time to screen applicants properly will help ensure a steady rental income, fewer headaches, and long-term success as a property owner.

Pro Tip: Use online platforms like Avail or RentRedi to streamline tenant applications and background checks.

Step 10: Manage the Property (or Hire a Manager)

Once you’ve secured a tenant, the next big decision is whether to self-manage your rental property or hire a property manager. This choice depends on your experience, availability, and willingness to handle tenant relations and maintenance issues. Both options come with advantages and challenges, so it’s important to evaluate which approach aligns best with your investment goals.

Self-Management: Pros & Cons

Managing your own rental property gives you full control over decisions, from tenant selection to maintenance and repairs. One of the biggest benefits is higher profitability since you won’t have to pay a management fee, which typically ranges from 8-12% of the monthly rent. This can add up to significant savings over time.

However, self-managing comes with greater responsibilities and potential stress. You’ll be the one handling tenant complaints, late payments, maintenance issues, and legal matters. If you own multiple properties or have a full-time job, managing everything yourself can quickly become overwhelming.

Hiring a Property Manager

For landlords who prefer a hands-off approach, hiring a property manager can be a worthwhile investment. While management companies charge 8-12% of the monthly rent, they take care of tenant issues, maintenance requests, rent collection, and legal compliance. A good property manager can save you time, reduce stress, and ensure your rental runs smoothly. This option is especially beneficial if you own properties in different locations or lack the time to handle day-to-day operations.

Ultimately, choosing between self-management and hiring a property manager depends on your level of involvement and investment strategy. If you value control and want to maximize profits, self-management might be the best choice. But if you’d rather have someone else handle the workload while ensuring steady rental income, a property manager could be a smart solution.

Final Thoughts: Is Buying a Rental Property Worth It?

Investing in rental properties can be a powerful way to build wealth, but it requires research, financial planning, and good tenant management. By following these steps, you’ll be well on your way to becoming a successful real estate investor!

Your Turn!

Have you bought a rental property? Share your experiences or ask questions in the comments below!